Stabilize or Vanish: The Final Play for Retail Pharmacy

Every industry hits a point where “fixing the system” stops being a strategy and starts being a fantasy. Retail pharmacy is there.

The capital runway is shrinking. The workforce is exhausted. The tech stack is rotting from the inside out. And the one demographic that kept the model on life support is aging out.

This isn’t a transformation story. There’s no elegant turnaround hiding in a future budget cycle. What’s left is a stabilization window—a brief period where disciplined operators can still control enough of the system to buy time.

Stabilization isn’t about growth. It’s about precision. It’s about controlling what you can, fast, while the uncontrollable keeps eroding around you.

If you’re an executive inside this industry, that window is closing whether you act or not.

The Stabilization Window

Every collapsing system has a brief window where stabilization is still possible. For retail pharmacy, that window is roughly a decade. After that, demographic decline, reimbursement compression, and automation economics converge and the model as we know it ends.

The objective now isn’t reinvention. It’s containment. The goal is to reduce volatility long enough to reposition around a smaller, leaner, digitally-enabled core.

1. The Myth of Transformation

Executives love the language of transformation because it implies control. But what’s needed now isn’t transformation — it’s triage. Transformation assumes the underlying system can be rebuilt. Triage accepts that it can’t, and focuses on extending survivability where control still exists.

Pharmacy chains don’t have the capital runway, workforce depth, or technology infrastructure for full reinvention. But they do have operational leverage in a few critical areas — areas that still move customer trust, cost, and time.

That’s where stabilization lives.

2. The Stabilization Equation

The logic is simple:

If you can’t grow margins,

and you can’t expand labor,

then your only path forward is to reduce operational drag faster than revenue declines.

Every hour you eliminate, every redundant handoff you close, every communication delay you remove. those become your last true profit levers.

This isn’t theoretical. Across healthcare and logistics, micro-stabilization projects that focused on real-time data visibility and accountability handoffs routinely yield double-digit efficiency gains even in declining industries.

The key is focus. When everything’s burning, you only save what you can actually reach.

3. The Stabilize-or-Vanish Matrix

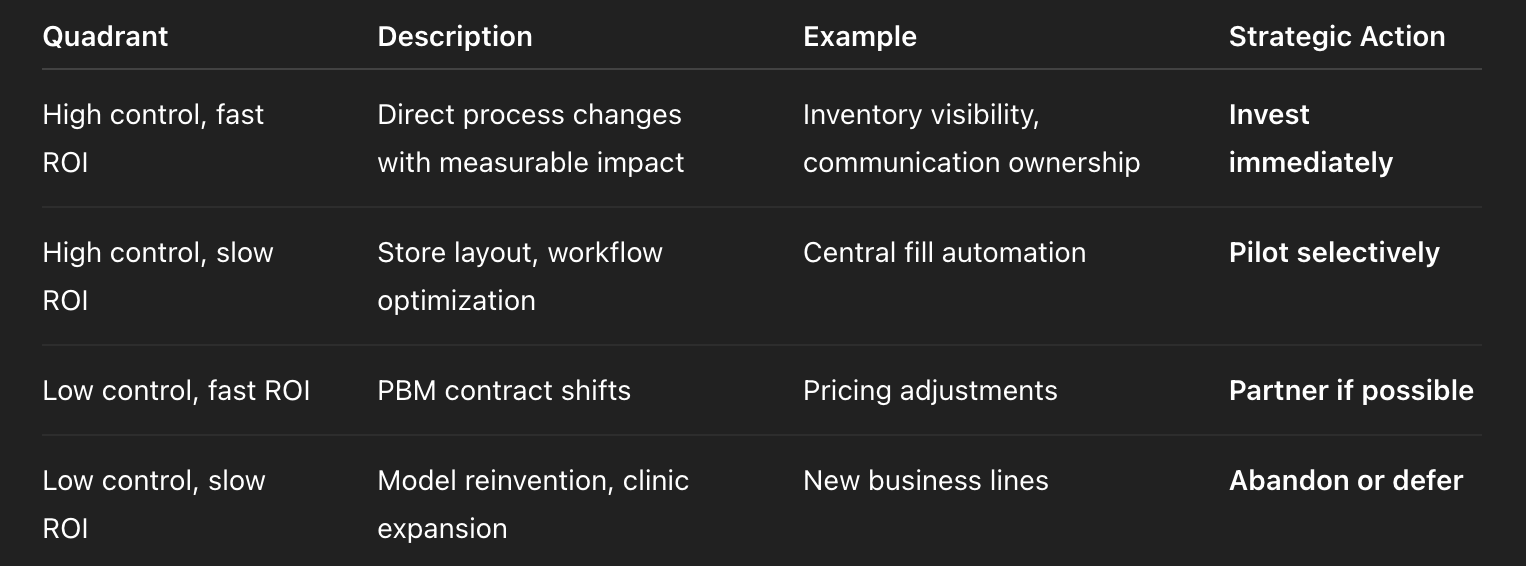

If you map every operational initiative against two dimensions — controllability and ROI speed — the choices become brutally clear:

The takeaway: only the first row — high control, fast ROI — deserves your immediate attention. Everything else either drags or distracts.

4. Defining Success: Buying Time to Evolve

Stabilization isn’t failure. It’s a disciplined form of survival. The goal is to create enough breathing room to evolve into what pharmacy’s next iteration will likely be: logistics-driven health nodes focused on chronic management, automation, and data transparency.

The winners of the next decade won’t be the ones who “transform.” They’ll be the ones who reduce operational friction faster than the model collapses around them.

That’s the play. And only two levers still make it possible.

The Two Levers That Still Matter

Pharmacy chains can’t fix everything but they can still fix what customers actually feel. Two operational levers remain fully under leadership control and yield fast, measurable impact:

Real-Time Inventory Transparency

Closed-Loop Communication Ownership

Both are deceptively simple, require almost no culture shift to implement, and they attack the core friction points destroying customer trust and internal efficiency.

1. Real-Time Inventory Transparency

The Problem: Every day, millions of patients are told, “We don’t have it in stock.” It sounds like a supply problem — it’s not. It’s a visibility problem.

Inventory data sits in disconnected systems: one for ordering, one for fulfillment, one for store-level tracking, and one inside the app that customers see. None of them communicate in real time. That gap creates false promises, duplicate calls, and preventable churn.

The Fix: A single, real-time visibility layer that synchronizes stock levels across fulfillment, distribution, and point-of-sale systems. Not a full digital overhaul — just one integration layer that acts as the source of truth for both staff and customers.

When the system says “available,” it means available. When it says “out of stock,” it means don’t waste a trip.

The Impact:

10–15 point increase in fill accuracy

30% reduction in duplicate staff calls

12% reduction in customer churn from failed fills

Noticeable lift in NPS and trust perception within 60 days

The Economics: Pilot-level implementation (50 stores, 3-month run) costs less than $2M and delivers measurable ROI within one quarter. That’s less than the annual loss from one month of refill churn in a midsize metro region.

Why It Matters: Trust is the last defensible asset in this industry. Real-time transparency is how you buy it back.

2. Closed-Loop Communication Ownership

The Problem: A single prescription can touch half a dozen employees and no one owns the outcome.

The Result:

Redundant handoffs

Contradictory answers

Hours of rework

Zero accountability

In operations language: there’s no process owner per transaction.

The Fix: Redesign refill workflows so that each request has a single accountable owner from initiation to completion. Ownership should be visible in the system, timestamped, and trackable. When customers send a message or request a refill, they’re not entering a queue — they’re entering a closed loop managed by one accountable party.

The Impact:

Reduction in labor hours spent per issue

Drop in communication escalations

Average resolution time cut from hours to minutes

Significant reduction in “who’s handling this?” confusion across teams

The Economics: The primary cost is workflow redesign, not headcount. ROI is realized through labor recovery and higher first-contact resolution.

Why It Matters: This is what Lean calls “eliminating motion and waiting,” but in plain terms: stop making customers and employees chase information that should already be connected.

The Strategic Payoff

These two levers don’t transform the business. They stabilize it. Fast. Visibly. Credibly.

They restore predictability, which is the rarest commodity left in healthcare operations. And they prove that disciplined process improvement still works, even in an industry that has lost faith in process.

With these in place, executives can finally stop firefighting and start planning what comes next. Not a resurrection of the old model. A controlled evolution of the next one.

From Optimization to Evolution

Once a system stabilizes, leadership faces a choice. Stop there or evolve. Most stop because they mistake temporary calm for recovery. Stabilization is not the destination. It’s the runway.

Pharmacy chains that survive the next decade will not do it by resurrecting a broken model. They will win by treating stabilization as the transition point between reactive retail and predictive healthcare logistics.

1. What Comes After the Patch

The last decade was defined by fragmentation. Systems. Staff. Customers. The next decade must be defined by integration.

Stabilization buys the one resource every leader is short on: time. Time to modernize the backbone. Time to rebuild around fewer stores, stronger data, and faster fulfillment.

The model that replaces today’s pharmacy will look less like retail and more like distributed healthcare logistics. Regional micro-fulfillment centers will feed automated, digitally managed prescription networks.

The human role will not disappear. It will change. Pharmacists will no longer be trapped behind counters reconciling orders. They will coordinate care, manage adherence, and operate as clinical touchpoints inside digital systems.

This is not science fiction. This is the path Amazon, Capsule, and Cost Plus are already on.

2. Redefining Value

Right now, most retail pharmacies measure success in transactions. Fill rates. Wait times. Script counts. That lens no longer works.

To evolve, chains must redefine “value” in operational terms that match customer behavior:

Speed: How fast can you confirm availability and completion?

Clarity: How few steps does the customer have to take?

Predictability: How often do you meet the promise you made?

Those three metrics will decide who survives.

3. Stabilization as Proof of Life

Executives should not underestimate what it means to stabilize something this complex. Reducing operational friction by just 10% in a legacy pharmacy network equals millions in recovered labor, retained customers, and avoided regulatory risk.

That is not a marginal gain. That is viability. Once that baseline is set, real innovation becomes possible again. Without it, every ambitious initiative—digital health, care integration, subscription models—will collapse under the same process debt that killed the last version.

4. The New Mandate for Leadership

The defining trait of the next successful pharmacy leader will not be charisma or cost cutting. It will be discipline. The willingness to focus on what can still be controlled while everything else shifts outside their reach.

Stabilization is discipline in practice. It is leadership through design, not reaction. And it is the only path that turns operational control back into strategic choice.

Executive Action Directive

Pharmacy chains do not need another transformation slogan. They need a 90-day proof of control. Evidence that leadership can still bend at least part of the curve before the rest of the system gives way.

Below is the simplest operational triage plan any chain can execute without waiting for a new fiscal year, vendor overhaul, or capital approval.

1. Pilot What You Can Measure

Launch a real-time inventory visibility pilot across 50 stores.

Objective: Create one source of truth between fulfillment, store stock, and the customer app.

Timeline: 90 days.

Cost: Less than $2M.

Success metric: A 10-point or greater lift in fill accuracy and a measurable drop in duplicate calls.

If it works, expand it. If it doesn’t, you will know exactly where the infrastructure is broken. Either way, you have an actionable path.

2. Redesign What You Can Own

Implement closed-loop communication ownership for refill requests. Assign a single accountable owner per transaction (human or digital). Track resolution time, escalation frequency, and redundant touches.

Success metric: 40% fewer wasted labor hours and 50% fewer handoffs.

This change costs almost nothing except focus. The return is hours, trust, and predictability.

3. Report What Actually Matters

Stop measuring volume. Start measuring volatility.

Every point of process stability—fewer exceptions, fewer callbacks, faster cycle times—translates into margin. Report those metrics to the board. Frame them as risk mitigation and cost recovery, not soft CX wins.

4. Decide What to Abandon

Subtraction is a leadership move. Kill any initiative that does not sit in the high-control, fast-ROI bucket.

If results are not visible within one quarter, you do not own the lever. And if you do not own it, it is not stabilization. It is noise.

5. Use Stabilization to Rebuild Credibility

No one expects a miraculous turnaround. But if your division can prove that operational control still exists, if you can reduce chaos without another billion-dollar transformation, you regain something more valuable than market share. You regain investor confidence.

The Path Forward

This is not about saving legacy pharmacy. It is about stabilizing it long enough to evolve into what comes next.

The winners of the next decade will not be the loudest or the most “innovative.” They will be the operators who pilot fast, focus hard, and pull the few levers that still deliver real impact.

Inventory visibility and communication ownership are not glamorous. They are controllable, measurable, and fast. And that is exactly what survival requires.

If you are in the boardroom right now, this is the moment to choose. Keep chasing transformation myths or start executing a stabilization strategy.

If you haven’t read Part 1 and Part 2, start there. This play only makes sense when you see the collapse and the stabilization levers in sequence.