Operational Discipline That Makes Investors Write Checks

Most founders sprint into product and sales, thinking the mess is just part of the "hustle." I've spent years behind the scenes, and I can tell you: that mess is the single biggest threat to your company, especially when you're preparing to raise capital.

Institutional investors view early-stage B2B startups not just as products, but as complex systems designed for scaling. After securing Seed funding, investors transition from underwriting your vision to underwriting your ability to execute predictably. They want to see how things run after a certain point, and if your internal disorder translates into inconsistent updates, unpredictable spend, or high churn, it's instantly viewed as a major structural red flag.

This isn't about bureaucracy. It's about establishing the basic operational backbone that demonstrates your ability to absorb capital and translate it into predictable revenue growth. Your goal is to eliminate the systemic risk that causes deals to stall and valuations to get cut, making your business an investable system from day one.

Operations Are Your Product

Founders often treat operational setup (files, contracts, internal processes) as a housekeeping chore. Wrong. Your operations are a revenue strategy. If a new customer's onboarding is sloppy, if your contracts look improvised, or if your invoicing is late, you lose credibility. That operational friction becomes a trust deficit that undermines your authority.

C-Suite Lesson: The True Cost of Internal Disorder

I once joined a brand-new team where the internal setup was held together with hope and vibes. The file system was basically a junk drawer, and approval requests pinballed through a dozen email chains. People weren't ineffective; they were operating inside a maze. Decisions dragged on, work slipped through the cracks, and the environment created confusion and quiet resentment.

My fix involved a structured approach:

Diagnose the Landscape: I met with operators in Sales, Marketing, Product, Legal, and Finance, tracing hand-offs, bottlenecks, and informal workarounds to figure out how the company actually worked.

Clarify and Formalize: I fleshed out the bare-bones meeting schedule into a full operating rhythm, clarifying the mission, goals, and individual responsibilities, and adding clear escalation paths.

The Immediate Payoff: The difference was immediate: decisions moved faster and conflicts dropped. These overall adjustments produced measurable results, including improving meeting efficiency.

Your operational clarity is what allows talent to succeed. If the way you get things done is dependent on your memory or a pile of sticky notes, your company isn't scalable.

Define Roles & Workflows That Actually Work

Chaos happens when no one knows what the team actually owns, or when work flows rely on assumption instead of structure. You need to turn abstract goals into concrete, repeatable steps.

Action 1: Define Roles & Responsibilities

Define and document a simple organizational chart with clear roles and responsibilities. Fuzzy responsibilities raise questions about scalability and are a primary cause of internal friction.

Define Decision Boundaries: Clarify exactly what a person owns, what requires escalation, and what can be done autonomously.

Establish a Team Charter: Capture your mission, key objectives for the quarter, and who owns what. This gives everyone a clear sense of purpose and accountability.

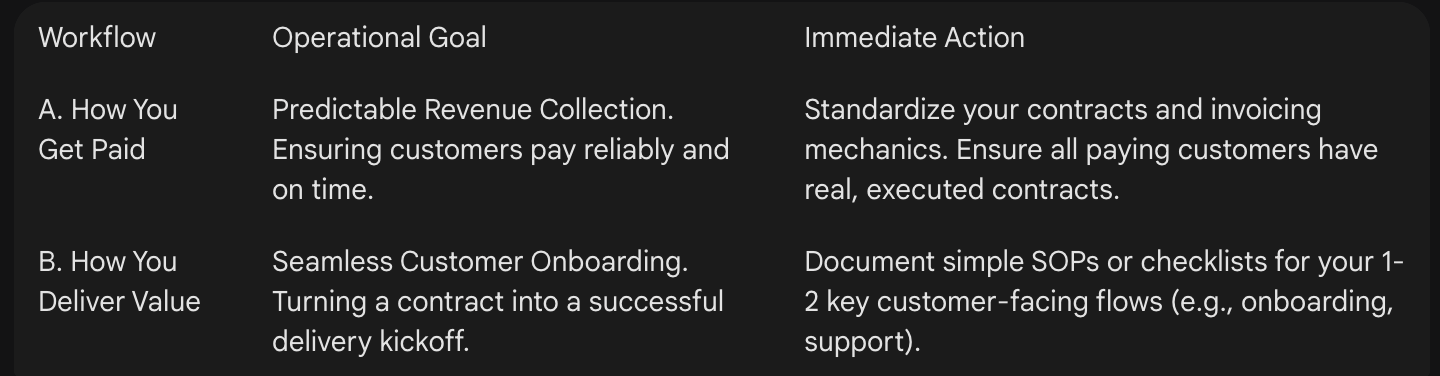

Action 2: Map the Two Workflows That Break First

These are the two functions—how you sell and how you deliver—that will sink your company fastest if left to chance. They have to be defined and predictable because their disorganization immediately creates a trust deficit with customers and leads to internal friction.

Defining these simple versions of your core workflows ensures you can:

Protect Revenue: By standardizing the flow, you prevent lost leads, late invoices, and scope creep.

Reduce Friction: You ensure every hand-off is clear, allowing your team to spend energy executing instead of clarifying.

Build Your Single Source of Truth

You don't need expensive software; you need intention. A single source of truth prevents the massive waste of time spent hunting down attachments, emails, or notes.

File Everything Centrally: Create one master folder structure for your business (e.g., 01 CLIENTS, 02 OPERATIONS, 03 FINANCE). Use a consistent file-naming convention.

Organize the Client Journey: Use a simple tool (like a spreadsheet or Kanban board) to track every client's status from first contact to delivery and payment. Track their Name, Service, Status (stages), and Next Action/Date.

Standardize Communications: Create Email Templates (Proposal Follow-Up, Welcome & Onboarding, Appointment Confirmation) and Process Checklists. This ensures every client receives a consistent, professional experience. (I LOVE creating these documents!)

Shape the System, Don't Run It

If the founder is doing everything manually, that’s normal. If the founder is doing everything manually without a repeatable pattern, that’s chaos disguised as hustle.

You're the System Architect: Your core responsibility isn't doing the work; it’s shaping the system others will inherit.

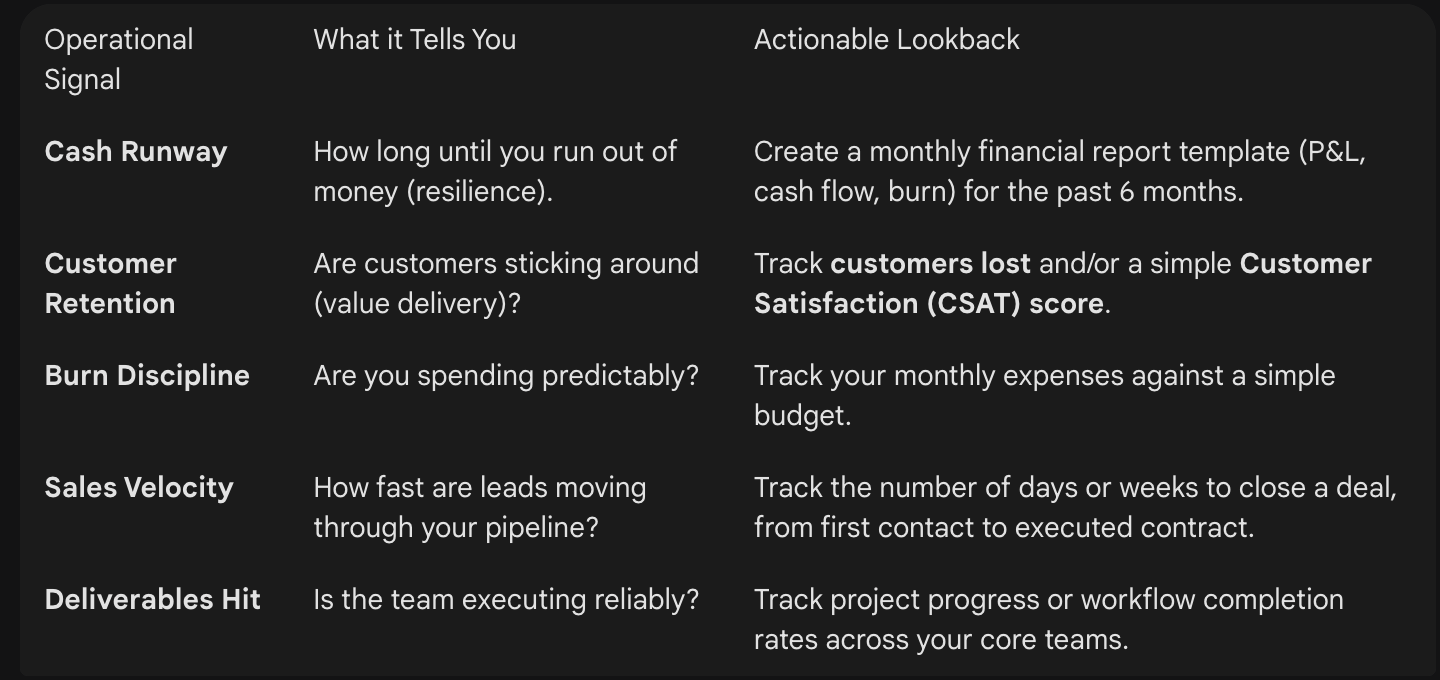

Track Signals That Show Your System Is Working: Stop guessing. Start tracking the handful of signals that confirm your stability and execution rhythm.

Autonomy, Scalability, and Valuation

Structure isn't bureaucracy; it's a strategic lever for autonomy and high performance. The small amount of operational discipline you instill today prevents the company from sinking into operational debt tomorrow.

By implementing these repeatable, documented basics—like clean contracts, codified workflows, and traceable metrics—you achieve a level of transparency and predictability that investors expect. This credibility layer is what unlocks capital faster and on stronger terms, because it demonstrates you can manage complexity.

The Investor Payoff

Your operational flaws aren't treated as minor administrative issues; they're indicators of systemic execution risk. When you build this predictable system:

You prove repeatability: Investors underwrite systems, not just vision or charisma.

You gain a valuation premium: Founders who demonstrate operational discipline raise on stronger terms.

You save runway: By preventing deals from stalling and avoiding unnecessary legal/financial cleanup, you waste less runway getting to your next funding round.

That's the foundation that allows your talent to thrive and transforms your startup into an auditable, systematic growth machine.

Actionable Takeaway: Start Today

Stop the Leak (Legal/Contract Hygiene): Commit 1 hour today to clean up your three most critical missing contracts/legal documents, confirming your sales are real.

Map the Money Flow (Predictability): Sketch out the 5-7 distinct stages a new customer goes through, from first contact to final payment, standardizing this core revenue workflow.

Define a Signal (Measurable Execution): Pick one key operational number (like Customer Retention) and commit to tracking it weekly for the next 30 days to establish your rhythm of execution.