Operational Maturity Is Your Hidden Fundraising Signal

Founders often believe that securing venture capital is purely about vision and market velocity. In reality, sophisticated investors underwrite a different quality: repeatability. Messy operations kill deals because they show up externally as inconsistent updates, unpredictable spend, and delayed follow-ups. Operational maturity is a primary screening mechanism, not a bonus.

Before your next pitch, ask: Could someone outside the company reproduce our results without asking a dozen questions?

Why Operations Shift from Internal Problem to External Signal After Seed

The transition between funding rounds marks a crucial inflection point.

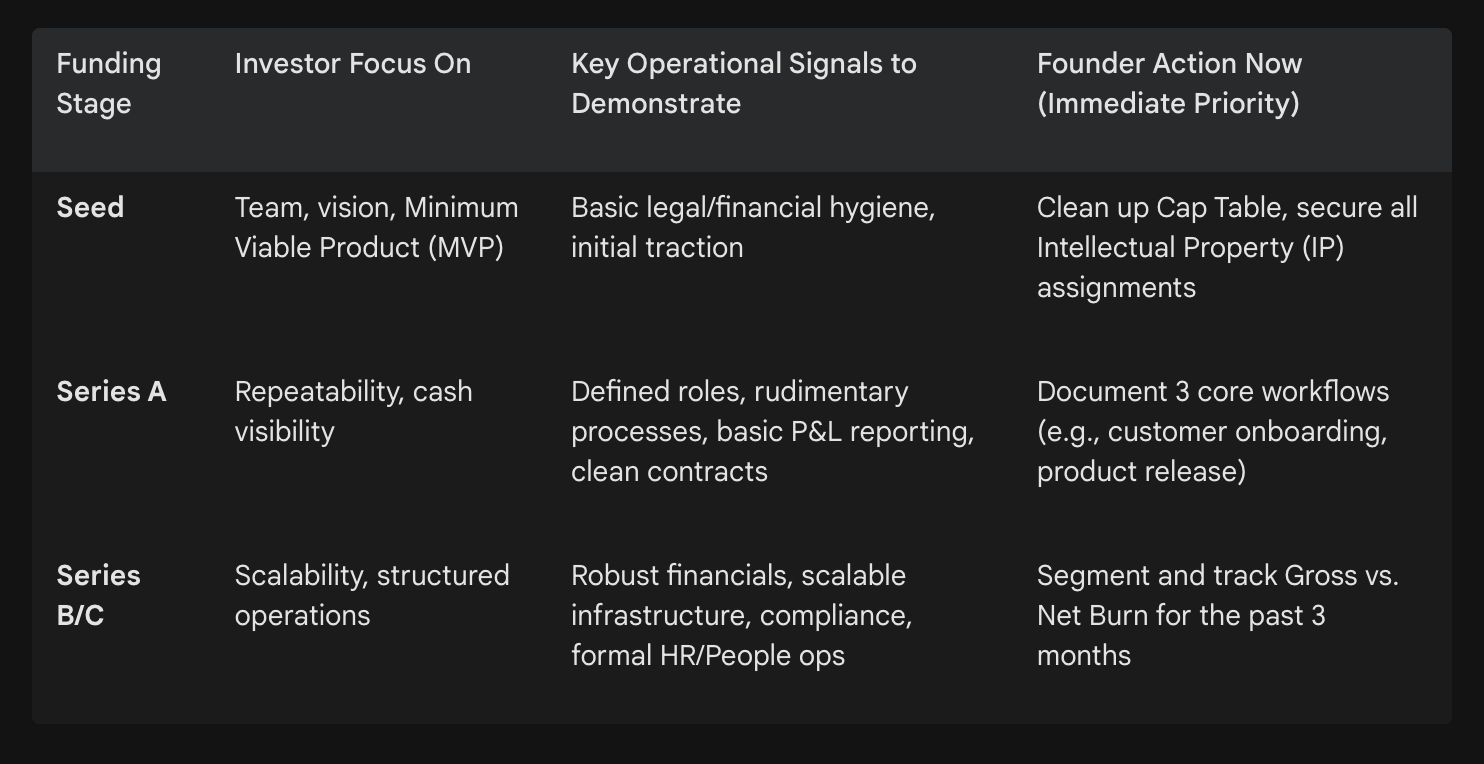

Seed investors primarily focus on team, founder-market fit, domain knowledge, initial product-market hypothesis, and basic traction or MVP. They expect early chaos but reward vision and passion.

Series A and B investors have a radically different expectation. They need evidence of a repeatable, scalable machine, not just a proof of concept. At Series A, investors want to see basic financial and cash-flow visibility, organizational structure with defined roles, and some process documentation. By Series B, robust financial controls, proper legal/IP hygiene, and scalable tech/operational infrastructure are expected.

Operational discipline becomes a core part of your credibility stack: it confirms your burn discipline, the accuracy of your reporting, your cross-functional alignment, your hiring judgment, and your overall rhythm of execution.

The Founder’s Blind Spot: Investors See Your Internal Disorder Long Before You Pitch

Founders think internal disorder is invisible, but it leaks out through persistent "tells" that investors read as high execution risk.

These signals immediately raise red flags:

Data Room Chaos: Files lacking dates, duplicate documents, or missing foundational records (e.g., P&L statements).

Messy Financials: Inconsistent accounting, unclear revenue recognition, or burn rate hidden in footnotes.

Unclear Ownership: Fuzzy team structure or roles, or key-person dependence on the founder.

Legal Gaps: Missing IP assignment agreements or non-standard customer contracts.

Inconsistent Metrics: Unlinked models where pitch deck metrics don't reconcile with spreadsheets.

Some may see these as normal consequences of "hustle," but investors read them as a profound lack of organizational discipline.

Founder Self-Check: Rate your team’s operational clarity (1–5, 5 being best) in Finance, Legal, Product, Sales, and People.

Operational Chaos Destroys Trust Even Inside the Company

My own experience confirmed the true cost of chaos inside. When I joined a brand-new team, the internal setup was held together with hope and muscle memory. The only structure in place was a weekly leadership meeting and a weekly team meeting. The file system was basically a junk drawer, so approval requests pinballed through a dozen email chains before they landed in the right place. People weren’t ineffective. They were operating inside a maze.

The impact showed up fast. Decisions dragged on. Nobody knew what the team actually owned. Work kept slipping through cracks that no one could see. The team was talented, but the environment created confusion, friction, and quiet resentment. I supported the executive who owned the team, and even I didn't like working with them because everything took twice as long as it should have.

Slowing Decisions: Disorganized files and unclear ownership slowed decisions and approval requests. This is read by investors as management lacking the discipline to manage complexity.

Talent vs. Process: The team was talented, but the lack of documented process caused internal friction and resentment. Investors assume if operations are dependent on founder memory, the company is "not scalable".

The Fix: I mapped real work flows (Sales, Marketing, Finance, Product) and built a simple operating rhythm: clear roles, firm escalation paths, and documented SOPs.

This internal dynamic ties directly to the investor lens: if your insiders distrust the team's ability to get things done predictably, outsiders will certainly apply a discount to your value due to perceived execution risk.

Operational Maturity is the Non-Technical Proof of Scalability

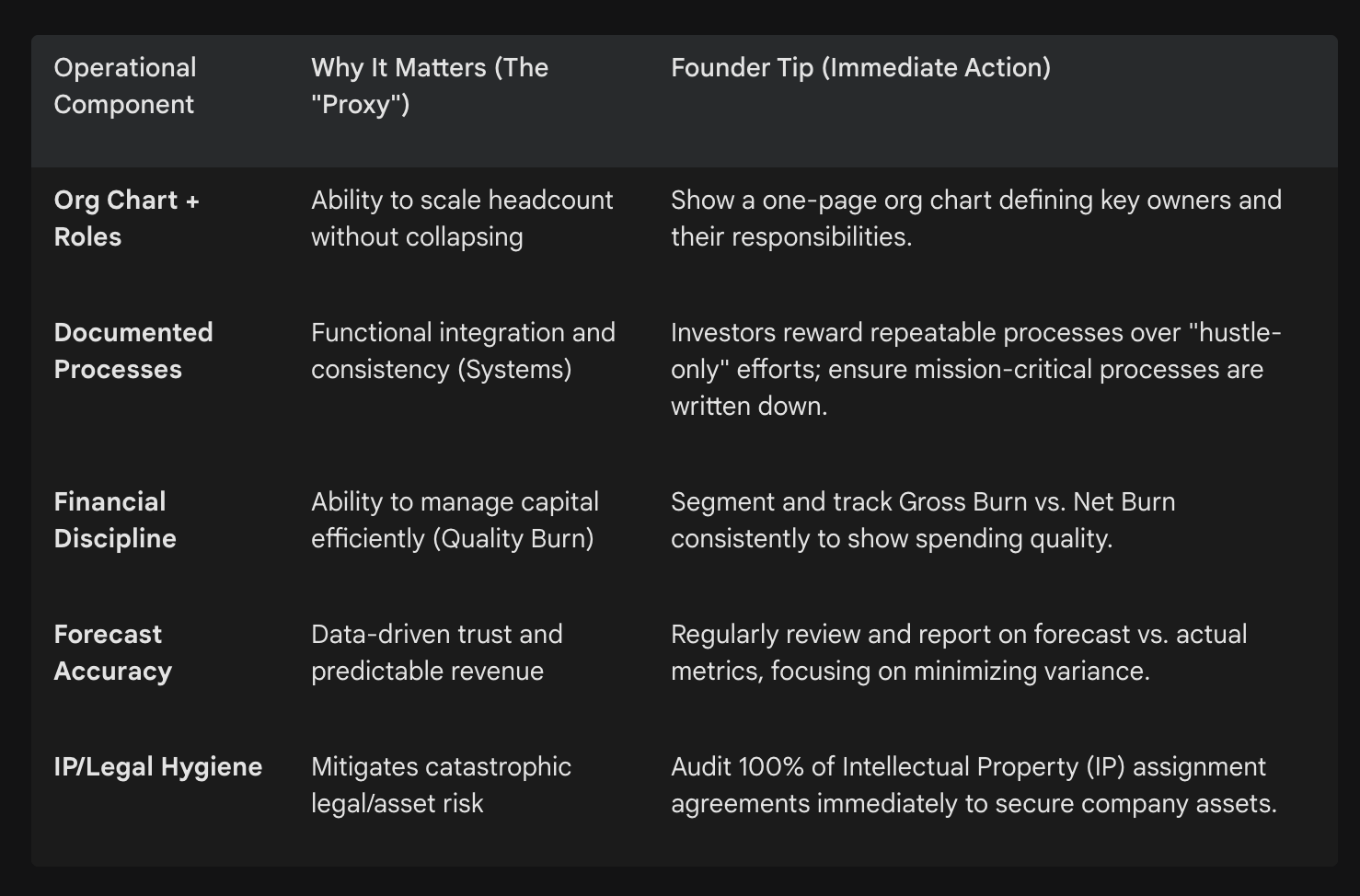

Investors already expect the technology to work; what they are really diligence-checking is the machine that builds, sells, and supports it. Operations becomes the verifiable evidence. This is critical because they are underwriting systems and processes, not just founder effort.

Operational discipline is interpreted as a Trust Proxy; if you can't manage finite, legally mandated processes (like IP assignment), investors assume you lack the discipline to manage the infinite complexity inherent in scaling a global business.

30-Day Founder Cleanup

Founders should focus on the highest-impact, lowest-cost shifts to materially improve investor perception. This isn't about building a full bureaucracy, but establishing repeatable, documented basics.

The goal is to focus effort where it removes the highest amount of risk, which directly impacts your valuation. Perform a quick audit and select the three items below that represent your company’s biggest failure points or largest risks.

Commit 1 hour per day for 30 days to resolve the three items below that represent your company’s biggest failure points or largest risks:

Minimal Diligence Stack: Build a well-organized data room with the Cap Table, signed IP/equity agreements, and incorporation docs.

Financial Visibility: Create and retroactively fill a monthly financial report template (P&L, cash flow, burn, runway) for the past 6 months.

Contract Legitimacy: Clean up contract templates and ensure all paying customers have real, executed contracts, avoiding LOIs. This validates that your sales are real, not "smoke & mirrors".

Core Workflow Docs: Document simple SOPs or checklists for 1–2 key customer-facing flows (onboarding, support). Codified operations signals you're not running on founder memory.

Org Clarity: Define and document a simple organizational chart with roles and responsibilities. Fuzzy responsibilities raise questions about scalability.

Metric Dashboard: Start tracking the 5 key metrics investors care about (e.g., Burn Rate, Cash Runway, CAC, LTV/Retention). Failure to track basic metrics is a recurrent waste pattern.

Conclusion: Operational Discipline is Your Greatest Attractor

Operational maturity is your hidden fundraising signal because it addresses the single question paramount to every investor: Can this team manage complexity?

Investors are underwriting systems, not just vision or charisma. Operational flaws—especially in legal (Cap Table, IP) and financial hygiene (Burn Quality)—aren't treated as minor administrative issues; they're indicators of systemic risk. They're the reasons deals stall, valuations get cut, and runway is quietly consumed.

You don't need full-blown bureaucracy early. You just need repeatable, documented basics and transparency. Clean up your financials, get your contracts in order, draft simple workflows, and track a handful of key metrics. That's the credibility layer that unlocks capital faster.

Founders who understand this raise on stronger terms, secure a valuation premium, and waste less runway getting there.

Improving operational maturity quickly can change investors’ perception of your readiness to grow.